More people are buying wearables than ever before—and Apple is in the lead

But the fastest-growing categories are ones Apple hasn't even touched yet.

The wearables category of consumer devices—which includes smartwatches, fitness trackers, and augmented reality glasses—shipped more than 100 million units in the first quarter for the first time, according to research firm IDC. Q2 2021 saw a 34.4 percent increase in sales over the same quarter in 2020.

To be clear: wearables have sold that many (and more) units in a quarter before, but never in the first quarter, which tends to be a slow period following a spree of holiday-related buying in Q4.

For the past several years, wearables like the Fitbit Versa have made up one of the fastest-growing categories of personal electronics, but the devices still lag far behind smartphones in terms of total units moved each quarter or year.

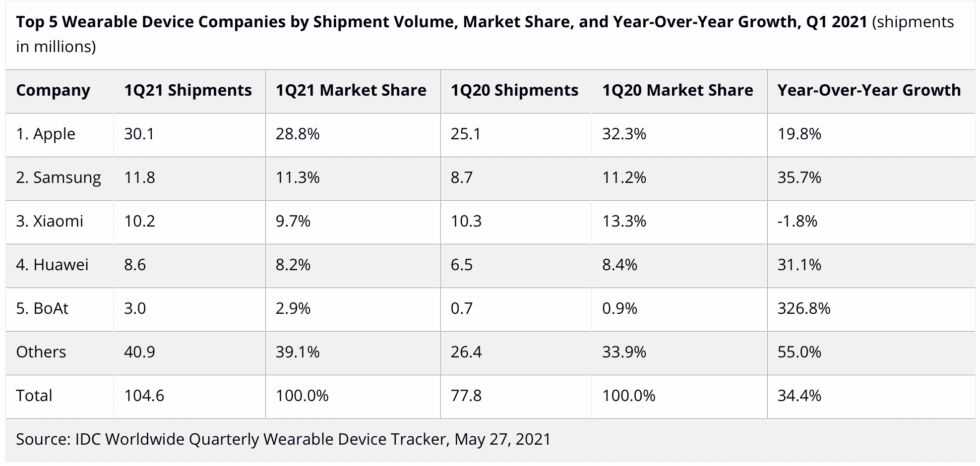

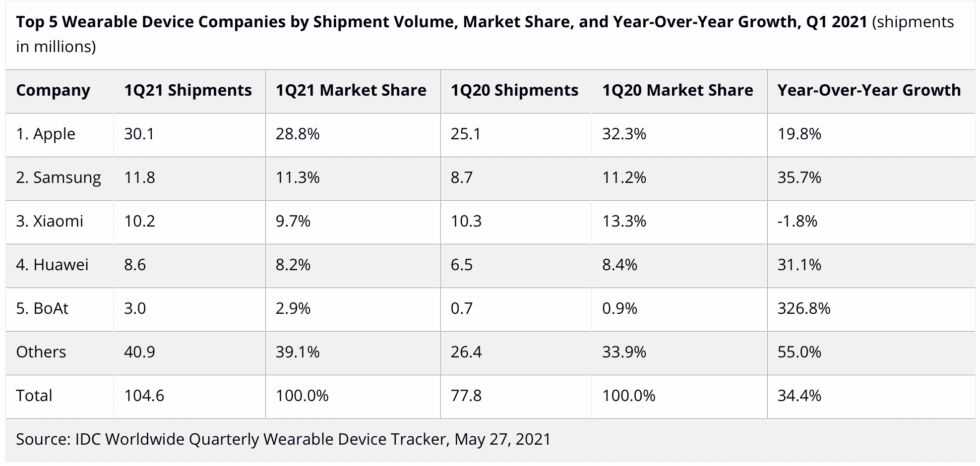

According to IDC's data, Apple leads the market by a significant margin, presumably thanks to the Apple Watch. In Q1 2021, Apple had a market share of 28.8 percent. Samsung sat in a distant second at 11.3 percent, followed by Xiaomi at 9.7 percent and Huawei at 8.2. From there, it's a steep drop to the smaller players—like BoAt, which has a market share of just 2.9 percent.

This table shows shipments by different companies in the wearables space as of Q1 2021.

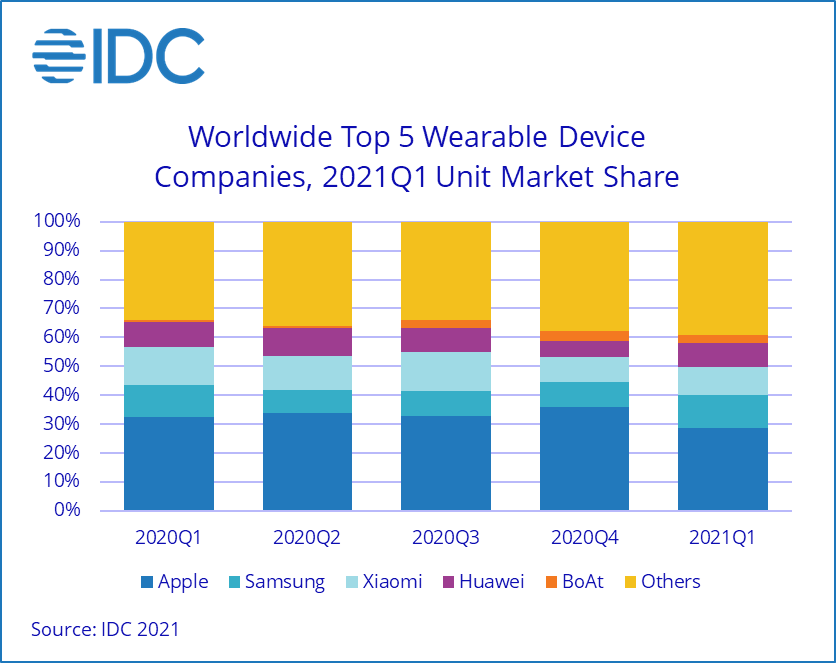

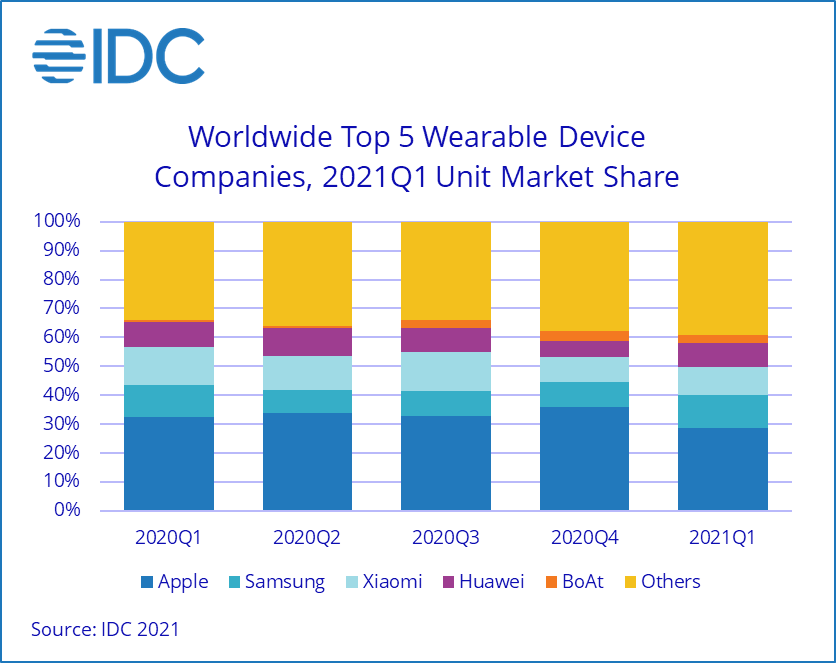

And here's a visualization of market share.

However, analysts say upstarts or smaller companies like BoAt are driving the significant year-over-year growth for wearables. Here's the word from IDC's research director for wearables, Ramon T. Llamas:

Larger companies have certainly drawn attention to the worldwide wearables market, yet it is the smaller companies fueling growth. Rather than compete head-to-head with products similar to the market leaders, these smaller companies have instead focused on specific markets and thrived with different solutions. For example, BoAt, the number five company on our list, has succeeded by concentrating only on the Indian market and was rewarded with triple-digit growth. Another example comes from Oura, whose fitness-tracking ring caught the attention of major sports teams and consumers. These and many other companies contributed to the Others category, which posted 55.5% year-over-year growth.

IDC's report says that the fastest growth comes from form factors besides smartwatches, such as digitally connected rings, audio glasses, and wearable patches. This grab-bag subcategory within wearables, which the IDC simply classifies as "other," actually grew 55 percent year-over-year.

Big tech companies like Samsung and Apple have repeatedly told investors in their quarterly earnings calls that wearables are among the fastest-growing sources of revenue and new users, and the companies have said the category will be a major focus moving forward. Currently, the wearables space is mostly dominated by wrist fitness trackers, but as the data shows, there are some signs that additional wearable types may break through. Analysts expect growth to continue for these in the future.

The result may be a personal computing landscape where users depend on a variety of specialized devices for specific circumstances rather than purely relying on a cell phone, tablet, or laptop as the one-stop hub. That said, if the way devices from Apple, Samsung, and Google work is any indication, many wearables are likely to treat the smartphone as a mobile nerve center for a plethora of connected devices.

More people are buying wearables than ever before—and Apple is in the lead

3175x175(CURRENT).thumb.jpg.b05acc060982b36f5891ba728e6d953c.jpg)

Recommended Comments

There are no comments to display.

Join the conversation

You can post now and register later. If you have an account, sign in now to post with your account.

Note: Your post will require moderator approval before it will be visible.