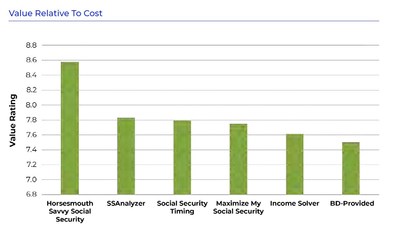

The advisor and client education program also rated "highest value" against five competitors

NEW YORK, June 2, 2022 /PRNewswire/ -- Horsesmouth's Savvy Social Security Planning® software and education suite has received top rankings in two separate advisor satisfaction surveys.

The 2021 Kitces Report: The Technology That Independent Financial Advisors Actually Use (And Like) and the T3/Inside Information Survey, 2022, both released studies recently showing advisors rank Horsesmouth's Savvy Social Security Planning program number one in satisfaction.

"We're pleased, as advisor satisfaction is our most important benchmark," said Horsesmouth CEO William T. Nicklin. "Whether you're a solo advisor or with a team, our software and education program gives you clear guidance on the best claiming strategies for your clients, and also teaches you about the underlying rules and concepts that make Social Security such a tricky topic."

The Savvy Social Security Planning program launched in late 2008, the first year the oldest baby boomers began claiming their retirement benefits. Since then, tens of thousands of advisors have used the program to learn how Social Security fits into their clients' retirement income plans, to test their newly developed skills through annual CE exams, and to educate clients and prospects with Finra-reviewed presentations and educational material.

"When we launched the Savvy Social Security Planning client education program, the financial services industry paid little attention to Social Security," Nicklin said. "No one seemed to believe that financial advisors should, would or could learn to understand the complexities of the system and help clients plan to make smarter decisions about claiming and maximizing their benefits."

Kitces Report: "Especially high marks"

In 2021, Kitces Research completed an invitation-only survey to advisors to learn which software and technology solutions they use and like.

"Most tools in the Social Security planning category scored remarkably similarly in terms of satisfaction, with the exception that B/D-provided tools rated very poorly, and Horsesmouth Savvy Social Security received especially high marks," the report said. "Notably, though, Horsesmouth is not just providing a tool like most competitors in this space, and rather also provides a package that includes access to professionals for Q&A, presentation templates, and more. Accordingly, Horsesmouth scored particularly well when it came to its value relative to cost as well."

T3/Inside Information: "Software All Star"

The annual software and technology survey from T3/Inside Information described Savvy Social Security Planning as a "Software All Star," having one of the highest satisfaction ratings across all software categories.

The report said all-stars are "solutions that stand out—specifically, that finished in the top five of their category in market penetration, and also achieved an extraordinary (8.0+) average user rating." Additionally, the Savvy Social Security Planning program was the highest rated "All Star" in its category.

Elaine Floyd, CFP®, Director of Retirement and Life Planning, noted that Horsesmouth's initial research in 2008 indicated that most advisors did not understand the Social Security rules. Many advisors urged their clients to claim as early possible. But because those advisors had not been trained on the complexities and nuances of the Social Security rules, they didn't realize their recommendations were unknowingly penalizing their clients.

"When people claim Social Security without getting a custom analysis of their needs, they're potentially leaving huge amounts of money on the table," Floyd said. "They're also possibly reducing the size of their annual cost of living raises and saddling their spouses with lower survivor benefits. And that's not even the whole planning picture."

A measurable impact

One of Horsesmouth's chief motives for developing the program 14 years ago was to help advisors steer their clients away from making hasty and ill-considered decisions when analyzing their Social Security options.

Historically, retirees have unwittingly claimed their benefits too early and suffered harsh, rules-based penalties for doing so. The good news is that according to the Social Security Administration, "between 2008 and 2018, the average claiming age increased from 63.6 to 64.7 for men and from 63.6 to 64.6 for women."

"We believe this can be attributed in part to the efforts of financial professionals educating pre-retirees across the country on how to maximize the benefits of Social Security as part of their retirement plan," Nicklin said.

Since its launch back in 2008, the Horsesmouth program has helped train and support tens of thousands of financial professionals and reached millions of pre-retirees and retirees. In that time, the Horsesmouth Social Security team, led by Floyd, has answered more than 18,000 questions about Social Security claiming cases posed by advisors, typically within 48 hours. "Outside of the Social Security Administration itself, we're not aware of any organization that has come close to that level of in-depth work assisting advisors with complex client cases," Nicklin said.

The Savvy Social Security Planning difference

The Savvy Social Security Planning software is integrated into a comprehensive financial education program for helping financial professionals educate themselves as well as their clients and communities. The software is valuable to financial professionals because it helps facilitate the process of engaging and working with clients and prospects. It is designed as a component of an overall system to enhance the advisor's ongoing education, marketing, client analysis and support, and more.

Over the years, Horsesmouth has continued to increase the depth of the software's capabilities to simplify the complexity of planning around couples, divorces, survivor benefits, WEP/GPO cases and much more.

In addition to providing optimized and popular claiming scenarios, it allows the financial professional, in collaboration with the client, to build and evaluate their own custom claiming scenarios. The software provides guidance along the way that teaches the rules of the system and prevents invalid claiming scenarios.

World class support, financial education

Technology alone does not solve the problems that financial professionals face in helping clients navigate the arduous process of planning for retirement. An essential part of the Savvy Social Security Planning program is providing world class support to advisors in the form of continual updates to educational materials and guidance, along with custom decision support for complex cases.

In addition to helping their clients, many of members of the Savvy Social Security Program are known in their communities as the go-to resource for guidance on Social Security. These advisors use the program's suite of Finra-reviewed presentations and marketing campaigns to deliver this vital financial education about Social Security and retirement planning in local libraries, colleges, restaurants, and offices.

"Educating the public about personal finance issues is the key way for advisors to distinguish themselves in their communities," Nicklin said. "That's why our Master Member program, which includes Savvy Social Security Planning and seven other Savvy topics, is our fastest growing program. Teams and solo advisors realize having finger-tip access to leading subject matter experts and reviewed educational material gives them the competitive advantage they need to guide their clients and stand out from their competitors."

- Karlston

-

1

1

Recommended Comments

There are no comments to display.

Join the conversation

You can post now and register later. If you have an account, sign in now to post with your account.

Note: Your post will require moderator approval before it will be visible.