After writing several articles on the real-estate market in Tokyo, I constantly come across the same myths.

The most prevailing myth is that Tokyo is still the same place as it was during its bubble hay-days in the 80s: The world’s most expensive city where everyone live in futuristic shoebox-sized pods that cost more than a mansion in the US.

What a lot of people must think Japanese apartments look like

Another myth I constantly hear is that Tokyo is a concrete jungle that is packed with massive skyscrapers.

Thanks to the researchers at the Greater London Authority Housing and Land Commission (link to their research paper HERE), I can now put these myths to rest once and for all:

Myth #1: Housing in Tokyo is Exorbitantly Expensive

Sure, rents in Tokyo are by no means cheap, especially compared to other cities in Japan. However, you got to take Tokyo for what it is: The world’s richest and most populous city (source here).

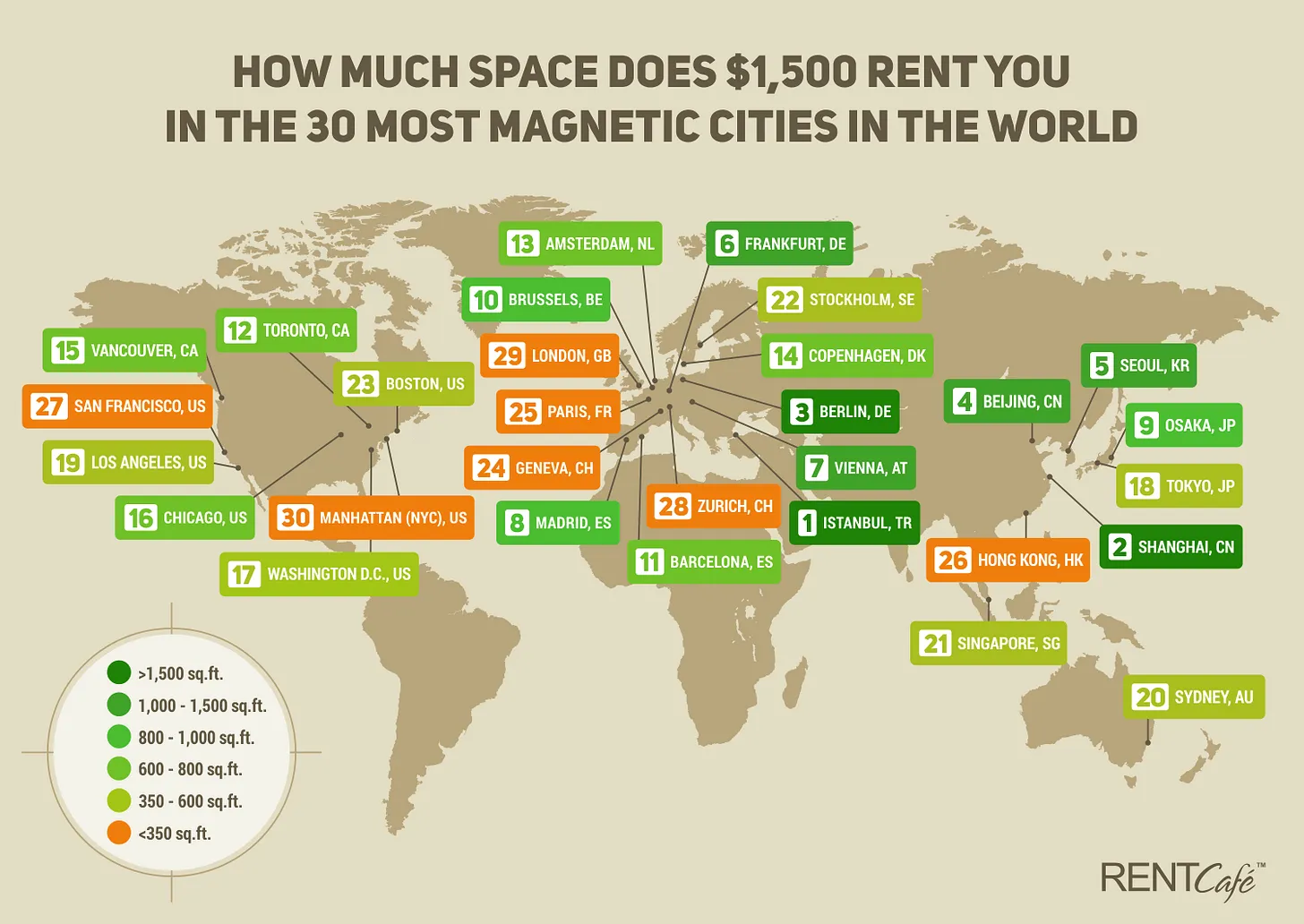

With that said, Tokyo is cheaper than most metropolises around the world:

Source: Rentcafe Global Housing Index (2017)

As the graph from 2017 shows, Tokyo is substantially cheaper than New York, London & Paris. The differences in rents have only widen since then as rents have risen much faster in those cities. On top of that, the Japanese yen has been dropping substantially this year which makes the gap wider than ever.

A common counter-argument is that salaries in those cities are higher and hence, people spend a similar percentage of their income on rent. However, Tokyoites allocate around 30% of their income on rent, while 40-50% is the norm in London, Paris, and New York City (source).

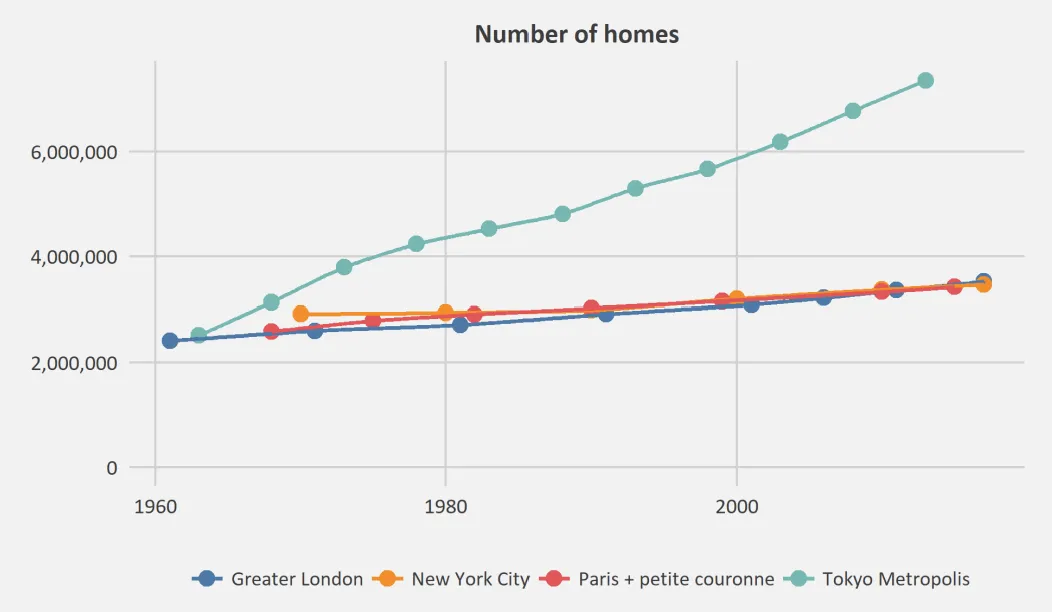

The main reason for this is that Tokyo builds so much more housing than those cities:

The GLA Housing and Land Authority (2019)

Since 1968, Tokyo’s housing stock has grown nearly 300%. By contrast, the other three cities have converged, although the underlying growth rates vary, with London’s housing stock having grown only by 36% since 1971, New York’s by 19% since 1970 and Paris’s by 32% since 1968.

*The reason why Tokyo’s housing stock has grown so rapidly in comparison to similarly sized cities can be found here.

Myth #2: People in Tokyo live in shoebox-sized apartments

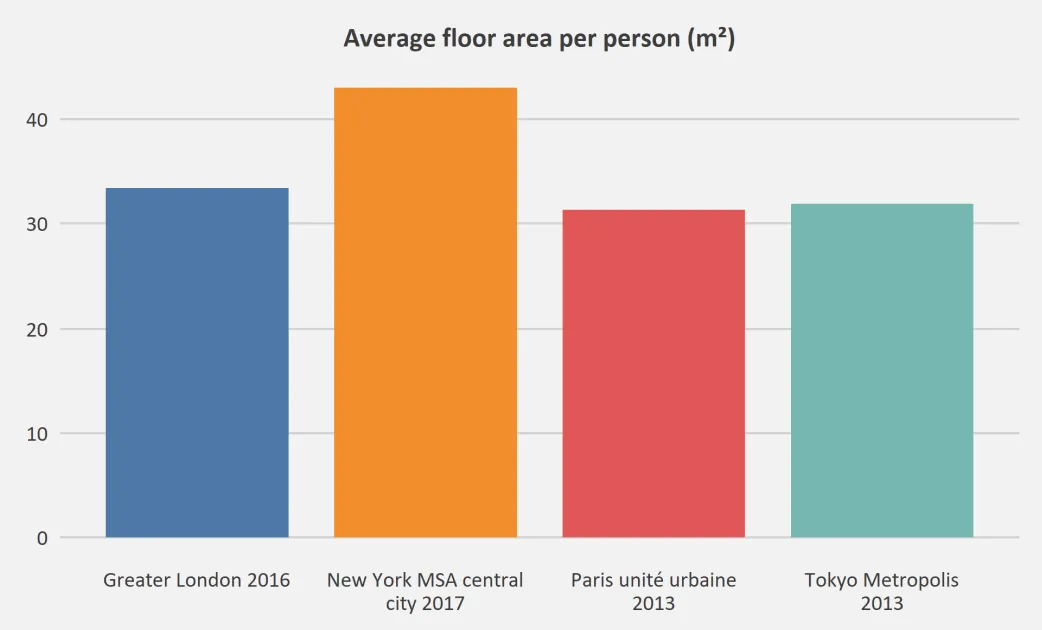

The second most common myth I hear is that people Tokyo live in shoebox sized apartments. In fact, the average person in Tokyo have the same amount of floor-area as Parisians and Londoners:

On the graph above, average floor area per person has been calculated by dividing average floor area per occupied dwelling by average household size. By this measure, Paris and Tokyo have similar amounts of space per person as London, at 31 sqm, 32 sqm, and 33sqm per person respectively. Only in New York does people have more space with an average of 43 sqm in floor area. However, New Yorkers also pay far more in rent per square-meter.

Even more striking is that more people in Tokyo live in detached houses compared to apartments (30%) than in New York (16.3%) and Paris (12.3%).

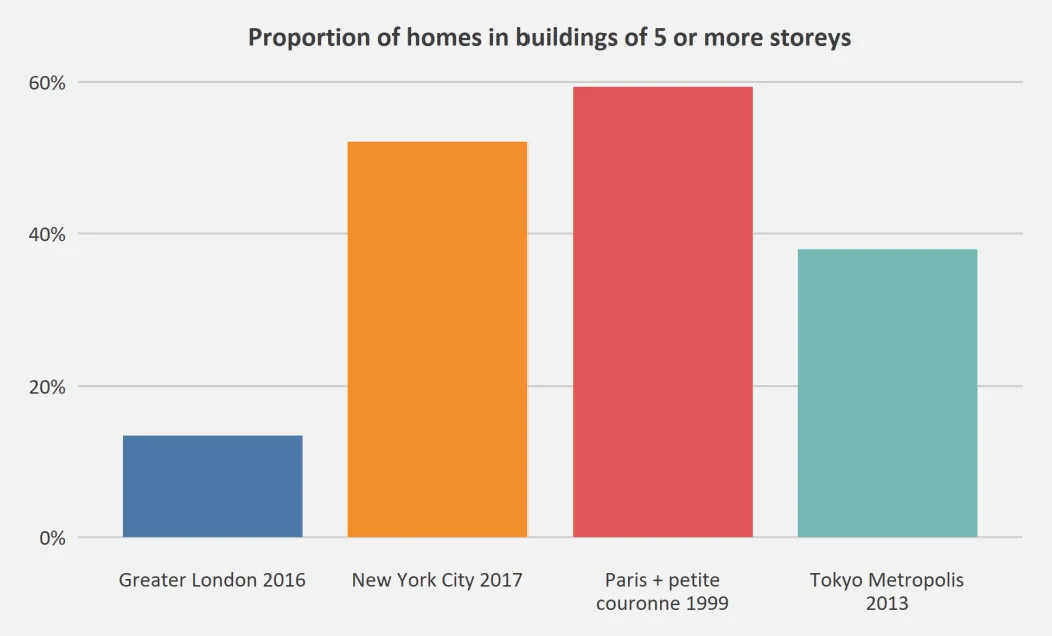

Myth #3: Tokyo is a concrete jungle cramped with massive skyscrapers

Tokyo is definitely a packed city with a lot of concrete towers, but its often lower and less dense than people think. In fact, the tallest building in Tokyo is only 255 meters (not even in the top 100 of world’s tallest buildings).

Toranomon Hills (255m) in Toranomon, Tokyo

In fact, Tokyo is much lower than both New York and Paris:

Perhaps even more shocking is that Tokyo is less dense than New York and Paris. Again, only Greater London is less dense than Tokyo:

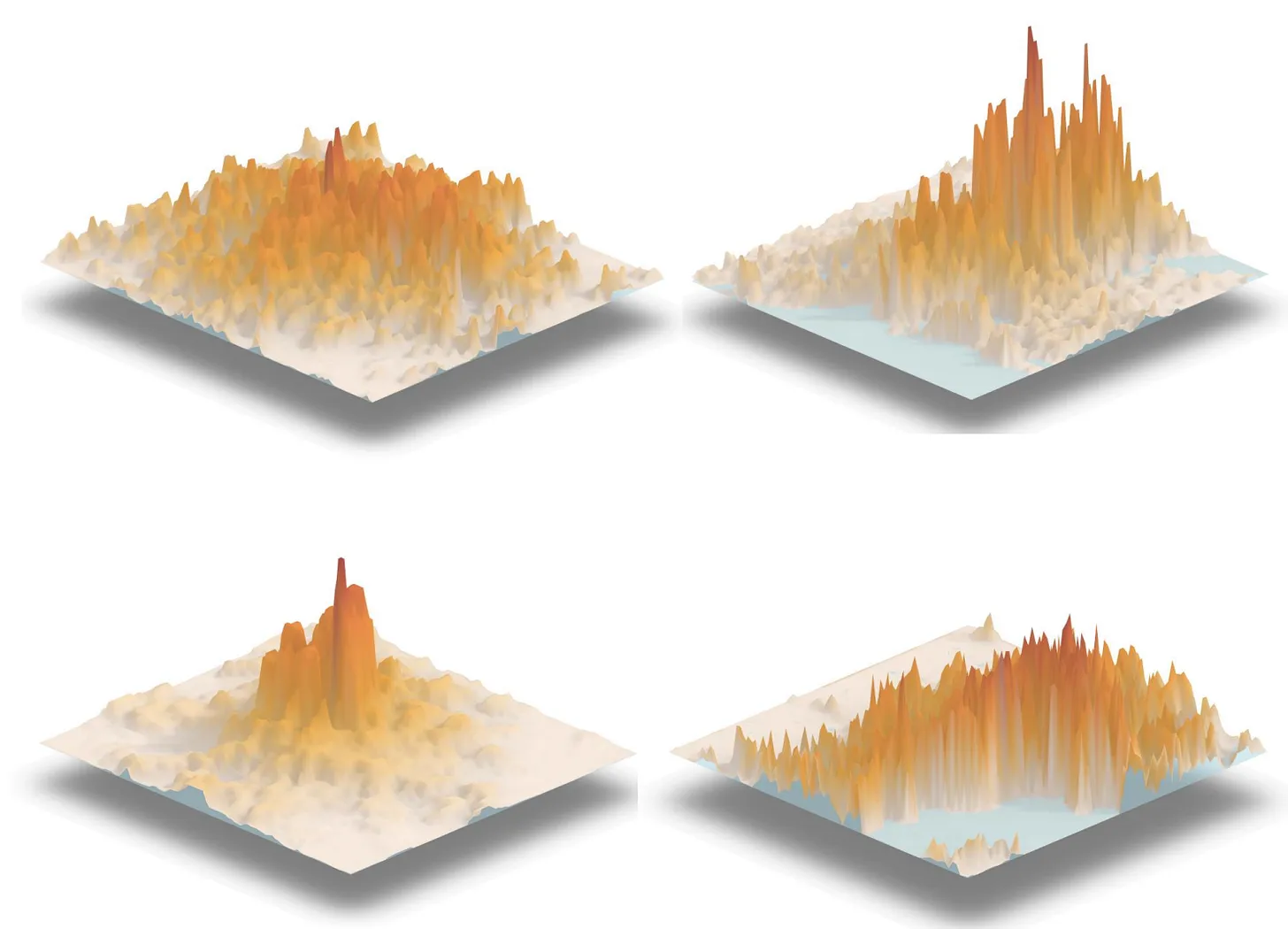

Below you can see a 3D visualization of population density with London top left, New York top right, Paris bottom left, and Tokyo bottom right:

As you can see, Tokyo is dense but not especially tall, whereas especially New York and Paris are incredibly tall and dense in the city center and very flat outside.

Conclusion

I hope this article have given some more clarity about housing in Tokyo. It’s not the capital of overpriced shoebox sized dwellings that you might have thought; but instead a very livable and affordable city.

As an investor, properties in Tokyo has underperformed compared to its peers, but even this is about to change. Prices are rising steadily here compared to its peers, especially now when we’re seeing property prices decreasing in London, New York and Paris while they are still going up in Tokyo.

At the end of the day, Tokyo is cheaper and more livable than New York, Paris and London, which is attracting a lot of people and investors. I am convinced that livability will be more and more important for a continued increase in real-estate prices, which is likely why we’ve seen more and more people and investors getting attracted to the city.

Recommended Comments

There are no comments to display.

Join the conversation

You can post now and register later. If you have an account, sign in now to post with your account.

Note: Your post will require moderator approval before it will be visible.