Founded in Dresden in the early 1990s, Germany’s Solarwatt quickly became an emblem of Europe’s renewable energy ambitions and bold plan to build a solar power industry.

Its opening of a new solar panel plant in Dresden in late 2021 was hailed as a small victory in the battle to wrestle market share from the Chinese groups that have historically supplied the bulk of panels used in Europe.

Now, Solarwatt is preparing to halt production at the plant and shift that work to China.

“It is a big pity for our employees, but from an economic point of view we could not do otherwise,” said Peter Bachmann, the company’s chief product officer.

Solarwatt is not alone. A global supply glut has pummelled solar panel prices over the past two years, leaving swaths of Europe’s manufacturers unprofitable, threatening US President Joe Biden’s ambition to turn America into a renewable energy force and even ricocheting back on the Chinese companies that dominate the global market.

“We are in a crisis,” said Johan Lindahl, secretary-general of the European Solar Manufacturing Council, the European industry’s trade body.

Yet as companies in Europe, the US, and China cut jobs, delay projects, and mothball facilities, an abundance of cheap solar panels has delivered one significant upside—consumers and businesses are installing them in ever greater numbers.

Electricity generated from solar power is expected to surpass that of wind and nuclear by 2028, according to the International Energy Agency.

The picture underlines the quandary confronting governments that have pledged to decarbonise their economies, but will find doing so harder unless the historic shift from fossil fuels is both affordable for the public and creates new jobs.

Governments face a “delicate and difficult balancing act,” said Michael Parr, director of trade group Ultra Low Carbon Solar Alliance. They must “maximize renewables deployment and carbon reductions, bolster domestic manufacturing sectors, keep energy prices low, and ensure energy security.”

The industry, which spans wafer, cell, and panel manufacturers, as well as companies that install panels, employed more than 800,000 people in Europe at the end of last year, according to SolarPower Europe. In the US almost 265,000 work in the sector, figures from the Interstate Renewable Energy Council show.

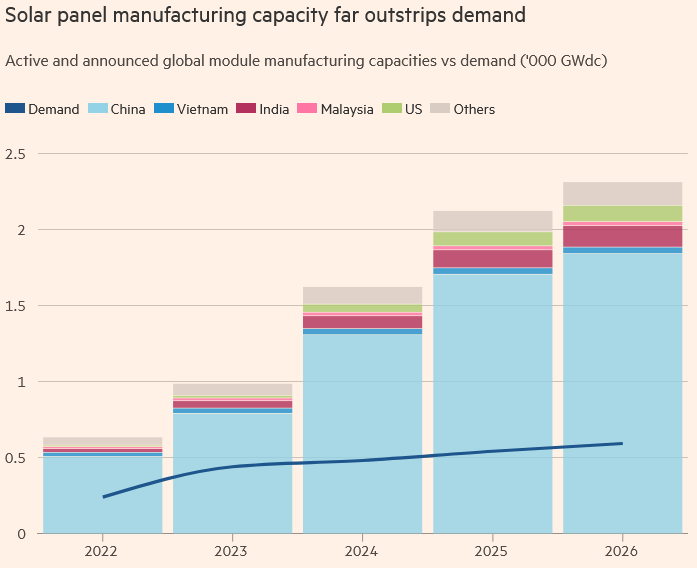

“There is overcapacity in every segment, starting with polysilicon and finishing with the module,” said Yana Hryshko, head of global solar supply chain research at the consultancy Wood Mackenzie.

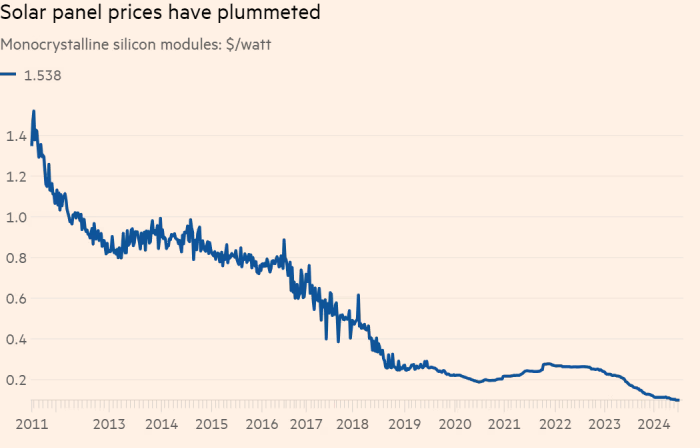

According to BloombergNEF, panel prices have plunged more than 60 percent since July 2022. The scale of the damage inflicted has sparked calls for Brussels to protect European companies from what the industry says are state-subsidized Chinese products.

Europe’s solar panel manufacturing capacity has collapsed by about half to 3 gigawatts since November as companies have failed, mothballed facilities, or shifted production abroad, the European Solar Manufacturing Council estimates. In rough terms, a gigawatt can potentially supply electricity for 1mn homes.

The hollowing out comes as the EU is banking on solar power playing a major role in the bloc meeting its target of generating 45 percent of its energy from renewable sources by 2030. In the US, the Biden administration has set a target of achieving a 100 percent carbon pollution-free electricity grid by 2035.

Climate change is a global challenge, but executives said the solar industry’s predicament exposed how attempts to address it can quickly fracture along national and regional lines.

“There’s trade policy and then there’s climate policy, and they aren’t in sync,” said Andres Gluski, chief executive of AES, one of the world’s biggest developers of clean energy. “That’s a problem.”

Brussels has so far resisted demands to impose tariffs. It first levied them in 2012 but reversed that in 2018, partly in what proved a successful attempt to quicken the uptake of solar. Chinese imports now account for the lion’s share of Europe’s solar panels.

In May, the European Commission introduced the Net Zero Industry Act, legislation aimed at bolstering the bloc’s clean energy industries by cutting red tape and promoting a regional supply chain.

But Gunter Erfurt, chief executive of Switzerland-based Meyer Burger, the country’s largest solar panel maker, is skeptical it will be enough.

“You need to create a level playing field,” he said. Meyer Burger would benefit if the EU imposed tariffs because it has operations in Germany.

3175x175(CURRENT).thumb.jpg.b05acc060982b36f5891ba728e6d953c.jpg)

Recommended Comments

There are no comments to display.

Join the conversation

You can post now and register later. If you have an account, sign in now to post with your account.

Note: Your post will require moderator approval before it will be visible.